Overview of Global CFO program – Professional Director Training | Pro CFO

The CFO program specialization is aimed at Financial Department Directors and Senior-level Financial Managers and for those who are assuming the role of key strategic collaborators for the CFO or the Board of Directors in the enterprise as well as for potential candidates who are pursuing a senior-level financial management career in financial institutions, auditing, or financial consulting firms. Corresponding to the rapid evolution of 4.0 Technology and sustainable financial development with legal and regulatory framework changes constantly; the education and training team brings together an alumni network, global partners, experts, and experienced financial planning and budget management leaders.

You will therefore further enhance your particular knowledge and develop quintessential financial skills that are compatible with your business strategy. The program covers a wide range of areas such as Leadership, HR management, Governance, Strategy, Finance, Auditing, Risk Management, Internal Control, Taxation, and Legal Practices. Emphasizing the case-study methodology and the Quintessence of our Experts community, the participants will get access to a variety of interactive training methods to be well prepared for the requirement of the CFO role. The program also features Workshops with high-level financial managers and senior auditors who will share their experience and insights into their career pathways, as well as their innovative ideas and discuss practices that have contributed to their success.

Course Outline

- Competencies and Authorities of a CFO

- Effective Leadership and Visionary Roadmap, Identity and Motivation

- Ethical and Responsible Decision-Making

- Creating Corporate Culture and Attracting Talent

- Driving Innovation and Orienting Strategies

- Driving Innovation and Steering Strategies

- Communicating Effectively with Stakeholders

- Inspirational Leadership

- Business Management for a Better Working Environment

- Practicing Sustainability Vision, Responsibility, Professionalism, and Code of Ethics

- Developing Strategic Plans for the Company to Maximize Shareholder Value

- Implementation of the General Strategic Plan

- Driving Strategies and Providing Guidelines for the whole Enterprise Structure

- Adopting Sustainable Development Strategy – a global, transdisciplinary vision for the future

- Developing an Annual Operating Plan

- Orienting Business towards the Global Sustainable Development Goals

- Approve Business Commitments within the limitations of the Board of Directors’ Delegated Approval Authorities

- Financial Strategic Management

- Project Planning and Management

- The Characteristics of Innovation and the Principles of Innovation Management

- Technical & Lean Innovation Concepts

- Creativity Management

- Using Innovation to Drive Portfolio Management

- Strengthening the Company’s Position as an Industry Leader in Smart Technology Adaptation

- Leading in-depth Analysis and Investigation into Breakthrough Technologies

- Evaluating Creativity Proposals from Team Members and Synthesizing Technology Innovation Reports to the Board of Directors

- Objectives of the Budget Planning – Overarching Principles of Financial Strategic Planning

- Methodologies of Budget Amendment

- Methodologies, Guiding Principles, and Procedures of Budget Planning

- Preparing the Annual Budget for Review and Approval by Board of Directors

- Managing and Overseeing the Annual Budget: Planning, Preparation, and Implementation

- Supervising Direction in the Planning, Organizing, Developing, and Conducting of Analyses and Evaluations of Company’s Budgetary Strategies, Policies, and Practices

- Cost, Profit Budgetary Planning

- Cashflow and Capital Sources Budgetary Planning

- Leading the Issuance of Policies, Standards, and Resource Budgetary Guidance Materials

- Overseeing the Execution of Approved Budgets

- Directing the Budgetary Control and Analysis

- Overview of Administration System and Management Reporting System

- Financial Management Tools and Methodologies

- Measuring and Reporting Financial Performance

- Interpreting and Elaborating on Financial Statements

- Leading the Elaboration of Financial and Budgetary Reports to the Board of Directors

- Preparing Financial Materials for Top-level Management Staff and Stakeholders

- Representing Financial Statements to the Board of Directors

- Financial Index and Financial Performance Analysis

- Efficiency Evaluation and Asset Assessment

- Capital Structure Assessment

- Financial Situation Evaluation

- Financial Risk Evaluation

- Fund Management

- Developing clear, concise business-driver-based variance analysis

- Preparing and Providing Annually Detailed Metric Reporting to Performance Benchmarking Processes

- Financial Tools and Leverage Analysis

- Foreign Direct Investment (FDI)

- Portfolio Management and Wealth Planning

- Making Capital Investment Decisions

- Performing Fundamental Investment Analysis Utilizing a Range of Evaluation Methods

- Identifying and Analyzing Financial Expansion Opportunities and Providing Equity Recommendations to Board of Directors

- Alternative Investment

- Equity Investment

- Derivative Investment

- Fixed Income Investment

- Stock Market

- Commercial Real Estate finance, including Commercial Appraising, Real Estate Market Analysis, and Investment Analysis

- Foreign Exchange Market

- Legal Systems and the Role of Regulation

- Introduction to Corporate Law

- Introduction to Property Auction Law

- Introduction to Taxation Management Law, Law on VAT, Law on CIT

- Introduction to Export and Import Taxation Law

- Leveraging Contract Law for Commercial Success

- Organizational Structure of The Financial Department

- Organizational Structure of The Sales Department

- Performance and Efficiency Evaluation System

- Managing Sales Team Performance – Effective Assignment of Tasks and Deployment of Workforce

- Designing and Structuring Your Team for Excellence

- Recruitment Evaluation; Human Resources Development and Training

- Application of Human Capital Management and KPI Software

- Organizational Management and Adaptive Management

- Overarching Principles of Auditing – Executing Integrated Audit Engagements Bringing to Bear Sophisticated Views on Asset Management Control Structures and Efficiencies

- Annual Financial Closing Procedure and IFRS Consolidation

- Audit Planning and Audit Implementation – Draft Audit Reports, and Present Issues to the Board of Directors while Discussing Practical Cross-functional Solutions

- External Audit Reporting and Control – Monitor, Assess, and Recommend Solutions to Emerge Risks

- Planning, Auditing, and Maintaining Enterprise Systems

- Understanding of External Audit Standards, Policies, and Local Regulations to Provide Timely Audit Assurance

- Introduction to Independent Auditing Law

- Executing Audit Engagements in Line with the Audit Methodology Related to Operational, Compliance/Regulatory, and Investment Risks

- Advocacy for Tax Administrative Procedure Reform

- Tax Regulatory Compliances (PIT, CIP, VAT)

- Overseeing Transfer Pricing Strategies and Compliance

- Leading and Supervising Tax Compliance, Tax Planning, and Related Financial Reporting Tasks

- Import Duty – Accounting Principles For Import Duty Refunds

- Import Duty Implementation – Free Trade Agreements – EVFTA and UKVFTA

- Corporate Income Tax And Non-Deductible Expenses

- Overseeing the Preparation of all Required Tax Filings and Compliance for the Entire Organization

- Transfer Pricing Adjustment By Local Tax Authorities

- Taxation Of Offshore Indirect Transfer Of Capital

- Direct Strategy to Increase Use of Government Incentives and Credits

- Risk Management for Taxation

- Governance, Risk Management, and Compliance

- Risk Management – Framework and Strategy

- Internal Audit Reporting and Control – Monitor, Assess, and Recommend Solutions to Emerge Risks

- Understanding of Internal Audit Standards, Policies, and Local Regulations to Provide Timely Audit Assurance

- Leading the Demonstration of Particular Consideration for the Firm’s Reputation and Safeguarding Financial Health

- Identifying Operational and Analytical Aspects of Risk Management and Governance

- Managing the Company’s Risk Monitoring System

- Identifying and Managing Risks in Different Contexts

- Developing and Maintaining Detailed and Dynamic Financial and Operating Models

- Delivering Financial Insights and Analyses to Key Functions

- Building and Reporting on Key Financial and Performance Metrics to Board of Directors

- Regular Reporting Deliverables and Investor Materials

- Developing New Tools for Measuring Revenue Performance

Course Outcomes

This program helps the participants to enhance their competencies in leadership, financial strategy planning, governance to drive efficiency, better operational performance, and financial performance, as well as enterprise risk management.

You will begin to build and strengthen a robust set of CFO’s key competencies in preparation for dealing with all financial aspects, namely formulating and implementing strategic visions based on the company operations model and financial analysis; assessing cohesion between the financial strategic plan and the long-term vision; considering benefits against risks to ensure sustainable growth; conducting effective communication with the Board of Directors and relevant stakeholders.

You will master the following potentials:

Module 1: Overview of Competencies and Authorities of the CFO

- Gaining perspective on the definitions of leadership skills

- Understanding culture deeply and then apply the learnings to change the operation as well as the culture of your recruiting team

- Growing awareness of how innovation helps you to achieve your goals

- Knowing how to conduct an effective stakeholder communication plan

Module 2: Strategic Management

- Defining the context of the company and building a strategic financial management road map in alignment with the company’s long-term vision

- Understanding the importance of developing an annual operating plan

- Analyzing the Strategic Management Tools and Techniques Usage

- Increasing awareness of how sustainability issues influence corporate strategy and how corporations may transform these challenges into sources of competitive advantage

- Growing awareness of long-term ethical and social-responsible commitments of the enterprise

Module 3: Accelerating Innovation and Creativity

- Adopting the Characteristics of Innovative and Creative Concepts

- Knowledge application: creating a road map for addressing critical factors in the product’s design and marketing

- Analyzing and investigating Breakthrough Technologies

Module 4: Advanced Budget Planning

- Implementing and evaluating the strategic budgeting

- Using different methods to build budget planning

- Leading the issuance of policies, standards, and budget guidance

- Planning, organizing, developing, and conducting analyses as well as evaluations of the company’s budgeting strategies, policies, and practices

Module 5: Financial Management Reporting System

- Achieving essential skills for evaluating and forecasting financial sustainability

- Developing essential toolkits for analyzing and utilizing financial statements

- Utilizing data analysis to inform the managerial decision-making process

- Understanding the market and the relationship between price and quantity through the economic principles

Module 6: Financial Analysis

- Analyzing financial performance and financial index

- Understanding fundamental principles and procedures in preparation for Financial Report

- Evaluating Your Financial Situation

Module 7: Financial Investment

- Evaluating portfolio management and wealth planning

- Acquiring a set of skills and evaluation procedures for making capital investment decisions

- Understanding of the trade flows and international trade theory regarding financial resources and investment opportunities

Module 8: Business Law for Financial Executives

- Gaining knowledge in Business Law to guide your business’s strategic direction, mitigate risk and make better-informed leadership development decisions

- Recognizing the pros and cons of different business structures

- Understanding the legal duties that a business leader may have

- Understanding contract structure and components in preparation for successful business deals

- Identifying of best practices required to comply with employment law

Module 9: Best Human Resource Management Practices for CFO

- Improving engagement and developing interpersonal skills

- Improving team dynamics through self-awareness

- Having a better understanding of team innovation and motivation

- Enhancing Performance Management Skills

- Succession Planning: Identifying and nurturing the team talent

- Boosting the team development

Module 10: Auditing for Executives

- Acquiring skills in assessing and evaluating Financial Performance

- Analyzing Fiscal Year-end Closing Procedures

- Understanding the process of Planning, Auditing, and Maintaining Enterprise Systems

Module 11: Taxation and Tax Consultancy

- Understanding the Annual Tax Finalization Procedures

- Understanding Taxation Regulatory Compliances

Module 12: Internal Control and Risk Management

- Identifying the key characteristics of corporate governance including the role of internal audit and assurance

- Gaining profound insights into key principles and guidelines of risk management

- Understanding the methodology used in risk identification and analysis

- Developing risk treatment strategies

- Assessing the relative benefits of embedded monitoring and independent assurance

- Adopting the principles and mechanisms used in internal control.

Module 13: Financial Strategy Orientation and Planning

- Having knowledge of Corporate Finance and The Objectives of the Financial decision-making process

- Understanding the Cost of Capital and Optimal Capital Structure

- Identifying the need for financial planning adaptation to change the corporate needs as well as to adapt to the changes in the economy and financial environment.

- Analyzing the comparative merits of owning and renting a home; tax implications; buying, selling; and leasing fundamentals.

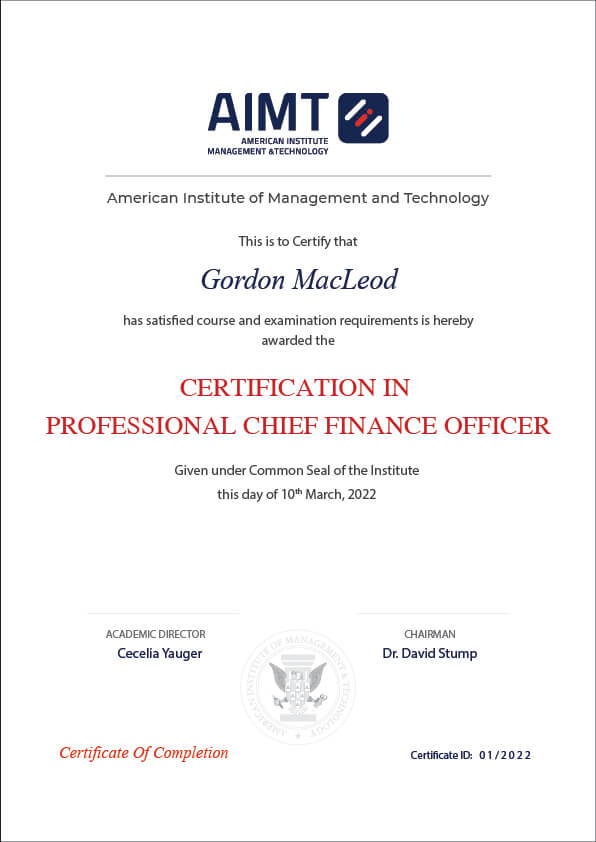

CFO Certificate by AIMT

Achieve an AIMT Executive Education Certificate upon successful completion of the program. As an alumnus of this transformative program, you get exclusive access to a wide range of professionals, events, and networking opportunities. Furthermore, you can also benefit from additional tuition assistance on enrolling in further online electives from AIMT.

This Certificate is aimed at leaders and managers who have attended the full courses and passed the assessment to be well prepared to lead change and the transformation organizations in order to create core values for the enterprise regarding the financial affairs